From CommonDreams

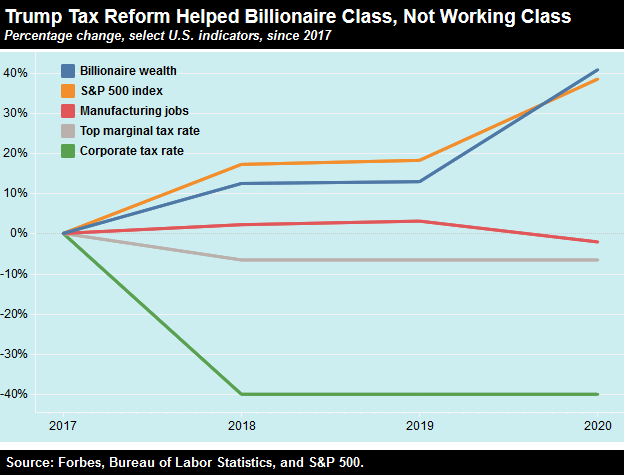

The Trump Tax Reform Helped the Billionaire Class—Not the Working Class

The Republican tax law boosted the fortunes of America’s wealthiest while increasing insecurity for U.S. manufacturing workers.

CEO and founder of Amazon Jeff Bezos participates in a discussion during a Milestone Celebration dinner September 13, 2018 in Washington, D.C. (Photo: Alex Wong/Getty Images)

“We gave you the greatest, biggest tax cut in history!” crowed President Trump at a recent rally in Prescott, Arizona.

If that rally crowd had been packed with billionaires, they would’ve had good reason to applaud. But for ordinary working families, the 2017 Republican tax law is nothing to cheer about.

Trump’s tax cuts for the rich are a major factor in the stunning growth in U.S. billionaires’ wealth — even as millions of other Americans are suffering. The billionaire class enjoyed a 6.6 percent reduction in their top marginal income tax rate, leaving them with even more money to cash in on stock market gains spurred by the law’s 40 percent cut in the corporate tax rate.

America’s wealthiest reap the vast bulk of Wall Street rewards not just because they have a vastly larger ownership share (The richest 1 percent holds more than half of all stocks and mutual funds), but also because they can afford to hire investment managers with the technological advantages to run circles around Mom and Pop investors.

As of October 13, 2020, the combined fortunes of the nation’s 644 billionaires totaled a jaw-dropping $3.88 trillion — up 40.7 percent since 2017, the year before the tax cuts went into effect.

By contrast, ordinary working families saw only modest reductions in their IRS bills after the Trump reform. At the same time, many of them faced heightened job insecurity because of provisions in the Republican tax law that gave big companies an even bigger incentive to offshore U.S. jobs to lower-wage countries.

Under the new law, multinational corporations owe zero U.S. federal taxes on foreign profits up to a certain threshold. Above that level, they owe Uncle Sam a tax rate that’s just half of what they’d pay for domestic profits. As a result, many big corporations pocketed Trump’s tax break and then shipped thousands of jobs overseas.

Trump’s perverse, job-killing corporate tax incentive is one cause of the dismal growth in U.S. manufacturing employment in 2018 and 2019, the first two years of the Republican tax law. The number of these traditionally high-paying jobs increased only 3 percent during this pre-pandemic period.

This is the world we live in. This is the world we cover.

Because of people like you, another world is possible. There are many battles to be won, but we will battle them together—all of us. Common Dreams is not your normal news site. We don’t survive on clicks. We don’t want advertising dollars. We want the world to be a better place. But we can’t do it alone. It doesn’t work that way. We need you. If you can help today—because every gift of every size matters—please do. Without Your Support We Simply Don’t Exist.

Please select a donation method: